2023 is shaping up to be a blockbuster year for Eli Lilly. With the company’s stock soaring by almost 54% since the beginning of the year, analysts are largely upbeat about Lilly’s expanded focus on obesity and diabetes treatments. While the company has developed insulin for a century, the company is now broadening its horizons with Mounjaro (tirzapetide), a diabetes treatment used off-label for obesity. An FDA approval for tirzapatide, a dual GLP-1/GIP receptor agonist, in obesity could occur later this year.

2023 is shaping up to be a blockbuster year for Eli Lilly. With the company’s stock soaring by almost 54% since the beginning of the year, analysts are largely upbeat about Lilly’s expanded focus on obesity and diabetes treatments. While the company has developed insulin for a century, the company is now broadening its horizons with Mounjaro (tirzapetide), a diabetes treatment used off-label for obesity. An FDA approval for tirzapatide, a dual GLP-1/GIP receptor agonist, in obesity could occur later this year.

While Lilly has seen its stock surge in 2023 thus far, its performance over the past month hasn’t been as robust — declining by close to 6% over the past month.

Momentum

“We continue to be pleased with the strong momentum of Mounjaro as more type 2 diabetes patients benefit from the medicine,” said Dave Ricks, chairman and CEO of Eli Lilly, in the company’s second quarter earnings call. In fact, despite ramping up production, the company acknowledged potential challenges in meeting the soaring demand for the drug.

On Wednesday, Eli Lilly announced a series of leadership changes, including the appointment of a new chief for its diabetes and obesity unit. This reshuffle comes in anticipation of a pivotal regulatory decision on Mounjaro, a potential blockbuster drug, for its use as a weight-loss treatment.

Tirzepatide projections from JP Morgan | Dulaglutide projections from GlobalData

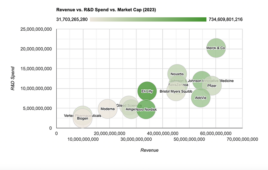

GLP drugs are emerging as mega-blockbusters. Lilly’s competitor, Novo Nordisk, saw its H1 operating profit increase from 37.5 billion Danish kroner in 2022 to 48.9 billion Danish kroner in 2023. Chief Financial Officer Karsten Munk Knudsen noted in an earnings call that the company’s growth was “probably the strongest growth in the history of the company.” One of the biggest sales drivers for the firm is semaglutide, which in 2021 became the first new drug for chronic weight loss since 2014.

Next-gen Novo Nordisk and Eli Lilly obesity initiatives

Novo Nordisk continues to work to expand the indications of semaglutide — in isolation in combination with cagrilintide. It has three Phase 3 trials namely CagriSema, Oral Sema, and a study on semaglutide 7.2 mg, exploring different administration methods and dosages for obesity treatment. The pharma giant also has a phase 1 study of amycretin in Japanese men with obesity.

Lilly is also testing next-gen approaches. Its oral nonpeptide GLP-1 receptor agonist orforglipron has shown promising results in clinical trials. In a study featured in NEJM, participants experienced a weight reduction ranging from 9.4% to 14.7% at 36 weeks, in contrast to the 2.3% in the placebo group.

Filed Under: Drug Discovery and Development, Metabolic disease/endicrinology