A recent review of more than 2,000 studies related at least indirectly to obesity on clinicaltrials.gov highlights the pronounced significant shift in research focus toward GLP-1 receptor agonists for a range of indications with at least some involvement of metabolic disorders. The site, which provides a robust but not-exhaustive snapshot of clinical trial activity, cites more than 290 unique studies involving the class, while roughly 150 total studies focus on the traditional mainstay, metformin, with roughly 25 studies of those investigating the combined use of GLP-1 receptor agonists with the drug. The far-ranging data set also includes trials involving insulin; SGLT2 inhibitors, DPP-4 inhibitors, thiazolidinediones and a significant number of studies centered around dietary supplements ranging from probiotics to walnuts.

Semaglutide still the GLP-1 heavyweight

If Novo Nordisk’s semaglutide were counted as a single drug, it would be second bestselling drug of 2023, with total sales of $19.93 billion compared to Keytruda’s (pembrolizumab) $25.01 billion. But the company markets the drug in three distinct forms. As an Ozempic, it generated $13.89 billion. While indicated for managing type 2 diabetes, recent interest in its off-label use for obesity has surged. The semaglutide variant for weight management, Wegovy, raked in $3.32 billion, while sales of the oral type 2 diabetes version of the drug, Rybelsus, hit $2.72 billion.

In metabolic-related trials, Novo Nordisk leads the pack

Speaking of Novo Nordisk, the company remains a leader in terms of GLP-1 clinical trials, with twice as many as the nearest competitor, Eli Lilly. Rounding out the top five sponsors in the clinicaltrials.gov dataset were Pfizer, Sanofi and Yale.

Novo Nordisk is cited as either a sponsor or collaborator 112 times and as a collaborator 21 times in the dataset. Contrast that with Eli Lilly, which is sponsoring 51 trials and collaborating on a dozen. Among the Eli Lilly trials is one for orforglipron (LY3502970), a novel, oral non-peptide GLP-1 RA, which is the subject of four trials in the clinicaltrials.gov data. Outside of obesity management, sample focus areas for the metabolic disease leaders include using GLP-1s to address obesity-related or -exacerbated risks like kidney damage and osteoarthritis.

Semaglutide: A clear star in GLP-1 trials

Semaglutide trials are surging, too, representing more than one-third of GLP-1 trials (as shown above). And a substantial amount of positive data is coming in. The phase 3 SELECT trial highlighted semaglutide 2.4 mg’s capability to cut the risk of major adverse cardiovascular events by 20% in individuals with obesity compared to a placebo, leading to an updated label for Wegovy. A novel combination therapy, CagriSema, which pairs the amylin analog drug cagrilintide with semaglutide, has entered phase 3 development in both type 2 diabetes and obesity.

Lilly’s tirzepatide, which may beat semaglutide 3-to-1 in terms of supporting weight loss goals according to early data released last year, is the subject of about one-third as many trials.

Meanwhile, Novo Nordisk’s liraglutide, which first won approval in 2010, is the subject of more than 30% of GLP-1 trials. Since approval, liraglutide has become a widely prescribed medication for both type 2 diabetes and obesity. It is marketed for weight management as Saxenda and for type 2 diabetes as Victoza.

Obesity: a much higher study focus than other metabolic disease areas

Precisely classifying the clinical trial types in the metabolic domain can be a fraught affair given the variability of descriptions, but taking a conservative approach to classification clearly reveals that trials involving obesity and overweight outnumber those focused more on type 2 diabetes about four to one. A perhaps surprising appearance in the top five focus areas was Prader-Willi syndrome, which is the focus of 56 studies. This highlights a burgeoning research interest in addressing genetic disorders that significantly impact metabolism.

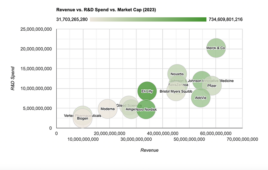

As the obesity epidemic continues to strain healthcare systems globally, the demand for effective pharmacological interventions is only expected to grow. Last year, drugs for metabolic disorders were among the top earners for Big Pharma companies as a class. By 2030, Goldman Sachs estimates the anti-obesity drug market alone could hit $100 billion by 2030. Already, the growth trajectory of Novo Nordisk and Lilly appears more robust and durable than that of many other life science firms, as illustrated below. As the role of obesity in diseases ranging form Prader-Willi syndrome to cardiovascular disease becomes increasingly clear, the potential impact of GLP-1 receptor agonists extends far beyond weight loss alone.

Filed Under: clinical trials, Drug Discovery, Metabolic disease/endicrinology