[Image courtesy of Adobe Stock]

High costs are a major barrier. A 2023 analysis found that achieving a 1% weight loss cost $985 with tirzepatide and $1,845 for semaglutide. If just 1% of the U.S. population used semaglutide, annual costs would hit $2.6 billion. With obesity rates around 40% and GLP-1 demand soaring, potential costs escalate further — annual Medicare expenditure could reach $26.8 billion if 10% of the U.S. population used semaglutide, the analysis concluded. A more recent analysis forecasts that by 2035, more than half of the global population will be classified as either overweight or obese, with the financial consequences of that reality potentially hitting $4.32 trillion each year.

A ‘huge cost’

“It’s a huge cost, and there are a lot of questions on how to combat that,” said Austin Jeffries, Ph.D., a senior business analyst at Lifescience Dynamics. Semaglutide is “an expensive drug,” and it’s unclear how much its cost would translate to insurance premiums, Sri Ranjan added.

Kyasha Sri Ranjan, Ph.D.

But the potential health benefits could offset these costs. “If GLP-1 drugs show cardiovascular benefits outside of obesity, it’s likely that some of these cost benefits will balance out,” Sri Ranjan noted.

The costs of chronic disease stemming from obesity and overweight are also astronomical. A Milken Institute study calculated that in 2016 alone, the total cost of chronic diseases related to excess weight was $1.72 trillion, equivalent to 9.3% of the U.S. gross domestic product (GDP). A 2021 study found that obesity in adults was tied with $1,861 excess annual medical costs per person, driving $172.74 billion or 11.9% of total U.S. healthcare expenditures. And medical spending related to obesity tends to be higher for adults covered by public health insurance programs ($2,868) than for those having private health insurance ($2,058).

Limited alternatives for safe and effective weight loss

Semaglutide and tirzepatide also happen to be some of the most effective drugs at supporting weight loss. There are few options available. In the 1990s, fenfluramine/phentermine (Fen-Phen) was a popular weight loss drug combination, but FDA withdrew it from the market in 1997 for potentially causing heart valve damage. Dexfenfluramine (Redux), a version of fenfluramine, was also pulled that same year. The appetite suppressant Meridia (sibutramine) was pulled from the market in 2010.

While drugs like phentermine, phendimetrazine and diethylpropion are still available, they tend to result in relatively modest weight loss. “For the weight loss indication, these are really the only drugs we have that are available outside of things like phentermine, which are cheap, generic, and not very effective, or liraglutide, which is a daily injection GLP-1 that only shows around 5% weight loss,” Jeffries explained.

Cardiovascular benefits of GLP-1 agonists

Austin Jeffries, Ph.D.

GLP-1s, however, offer potential benefits beyond weight loss, which is, in itself, linked to a host of medical issues. The landmark SELECT trial (NEJM, late 2023) demonstrated that semaglutide reduced major cardiovascular events by 20% in patients with overweight/obesity and cardiovascular disease, even without diabetes. This finding expanded semaglutide’s label to mention potential cardiovascular benefits.

“With the recently seen cardiovascular benefits, such as a 20% reduction in major adverse cardiovascular events (MACE), it adds more evidence to the space outside of obesity,” Jeffries noted, emphasizing the broader implications of these findings.

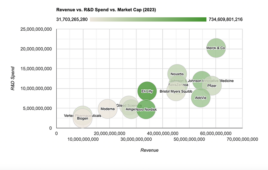

A flurry of clinical trials are exploring the potential of GLP-1 drugs, particularly semaglutide, with promising early results. Much of the data to date has been positive. “Eli Lilly, Novo Nordisk, and some smaller companies are starting to see what other health benefits losing this weight might incur for patients. The big one is cardiovascular health,” said Austin Jeffries, senior business analyst at Lifescience Dynamics.

Impressive weight loss results

The introduction of semaglutide, in particular, has marked a significant advance in the field. Developed by Novo Nordisk, this once-weekly injectable has shown impressive results in clinical trials. In the STEP 1 trial, participants on Wegovy lost an average of 14.9% of their initial body weight over 68 weeks, compared to 2.4% in the placebo group. In the SURMOUNT-1 study focused on Mounjaro, participants taking the highest dose (15 mg) achieved an average weight loss of 22.5% over 72 weeks.

The growing popularity of GLP-1 drugs comes as the public begins to view obesity as a disease rather than a personal failing, as the Obesity Action Coalition has stated. The American Medical Association notes that obesity is associated with over 200 comorbidities ranging from several forms of cancer to heart disease.

Potential to slow disease progression

The potential of drugs like semaglutide to reduce the risk of heart failure has “implications” for drug status beyond obesity. “Reducing obesity has an impact on lots of different other things like osteoarthritis or cardiovascular events,” Sri Ranjan said.

The clinical benefits of these drugs extend beyond mere weight reduction. Jeffries highlights the potential for GLP-1 agonists to slow the progression of diabetes and kidney disease, noting, “They’re starting to see signs that there’s a slower progression to diabetes,” he said.

“Now, even with the SELECT trial, they’re starting to see signs of a slower progression to diabetes, which would be a huge benefit if you could preempt going into diabetes,” Jeffries added, underlining the potential for disease prevention.

Improving quality of life

Clinical trial results suggest that GLP-1 agonists could significantly improve daily life for heart failure patients. “There is a high unmet need for this population,” Jeffries said.

Quality of weight loss is important to preserve muscle mass, especially in the elderly. As Jeffries points out, “Another issue is the quality of weight loss, which is going to have a big impact. We know these drugs can lead to weight loss, but if you’re losing a lot of muscle, this might be bad for the elderly.” Weight regain after stopping is a concern, as are GI side effects and intense rebound hunger cravings.

Beyond ‘vanity’ drugs

To persuade payers that next-gen obesity therapies are more than “vanity drugs,” pharma companies must continue to study them in a range of clinical trials. Hundreds of trials are either underway or completed that have at least some GLP-1 component. “All of this is aimed at getting the drug reimbursed because payers don’t want to pay just for a lifestyle drug; they want to see an actual health benefit,” Jeffries explains. Novel pricing/reimbursement models like outcomes-based agreements could improve access. “There’s always an option of tying it to outcomes in terms of sharing the risk between the manufacturer and whoever is being the payer. It would be interesting to see if that dynamic does move on. It would be one way to address the high cost,” Jeffries added.

Challenges and considerations

GLP-1s, while promising, are not a cure-all. A major concern with GLP-1 agonists is the risk of weight regain after stopping treatment. “In every scenario where they looked at it, there’s weight gain once you restart the drug, and that’s going to be a huge problem,” Austin said.

In addition to weight regain, GLP-1 agonists can cause a range of gastrointestinal side effects. “When you stop using them, patients have really intense hunger cravings and it’s really hard to combat that,” Jeffries said.

The aforementioned high cost of the therapies will likely be an ongoing challenge for payer coverage. The North Carolina State Health Plan called the pricing of semaglutide and liraglutide “unfair,” and said it is considering ending coverage, as continuing to pay for the GLP-1s is projected to cost more than $1 billion in the next six years and require significant premium increases for members.

Strategic considerations for pharma companies

As obesity and cardiovascular treatment evolves, pharmaceutical firms face complex challenges in promoting GLP-1 agonists. Robust clinical trials demonstrating multifaceted benefits are essential. “Companies need evidence from various trials to showcase not only functional outcomes, but improvement in patient symptoms,” Sri Ranjan said.

Alongside clinical data, novel pricing models could help expand patient access. Jeffries suggests outcomes-based agreements as a possibility: “Tying reimbursement to outcomes could mitigate risk for both manufacturers and payers — it will be interesting to see if that model gains traction.”

References:

- Nguyen T, Wong E, Cope R. Evaluating the Efficacy and Pharmacoeconomics of Semaglutide and Tirzepatide in the Setting of Obesity. Am J Ther. 2023;30(4):e347-e352. doi:10.1097/MJT.0000000000001643

- Milken Institute. America’s Obesity Crisis: The Health and Economic Costs of Excess Weight. 2016. https://milkeninstitute.org/report/americas-obesity-crisis-health-and-economic-costs-excess-weight

- Lincoff AM, Brown-Frandsen K, Colhoun HM, et al. Semaglutide and Cardiovascular Outcomes in Obesity without Diabetes. N Engl J Med. 2023;389(24):2221-2232. doi:10.1056/NEJMoa2307563

- Novo Nordisk A/S: Semaglutide 2.4 mg reduces the risk of major adverse cardiovascular events by 20% in adults with overweight or obesity in the SELECT trial. News Release. August 8, 2023. https://www.novonordisk.com/news-and-media/news-and-ir-materials/news-details.html?id=166301

Filed Under: clinical trials, Drug Discovery, Metabolic disease/endicrinology