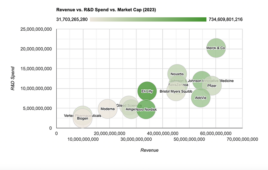

Eli Lilly’s diabetes medication Mounjaro (tirzepatide) is seeing explosive sales growth, jumping from $187.3 million in the third quarter of 2022 to $1.4 billion in the same period this year. Conversely, sales of Lilly’s Trulicity, another diabetes drug, have declined, dipping from $1.85 billion in Q3 2022 to $1.67 billion in Q3 2023.

Eli Lilly’s diabetes medication Mounjaro (tirzepatide) is seeing explosive sales growth, jumping from $187.3 million in the third quarter of 2022 to $1.4 billion in the same period this year. Conversely, sales of Lilly’s Trulicity, another diabetes drug, have declined, dipping from $1.85 billion in Q3 2022 to $1.67 billion in Q3 2023.

Mounjaro is selling so briskly that Lilly is having trouble making enough of it. The company is aiming to boost supply by recruiting a diverse portfolio of contract manufacturers. It plowed $450 million in its Research Triangle Park facility in North Carolina to support additional drug filling, device assembly, and packaging capacity. It also invested an additional $1.6 billion in new manufacturing sites in its home state of Indiana. Despite the efforts, the company notes that supply problems have led to “intermittent delays” in filling orders and tight supply of the medication throughout most of the third quarter.

Progress in bolstering Mounjaro capacity

“In terms of Mounjaro supply, we’re continuing to make progress on our manufacturing expansion agenda,” said Anat Ashkenazi, chief financial officer, in an earning call. “Given strong demand, we continue to experience tight supply throughout most of Q3, which impacted results for the quarter.”

The company aims to double production of the drug by the end of the year.

Lilly is also aiming to win FDA approval for tirzepatide for obesity. In 2022, FDA gave the drug Fast Track designation for that indication.

In August, BMO Capital analyst Evan Seigerman projected Mounjaro would generate peak sales of $68.7 billion.

One wild card that could affect potential demand for the drug is its durability in supporting weight loss. In the earnings call, Mike Mason, the president of Lilly Diabetes, suggested that Mounjaro has the potential to offer better long-term results for weight loss compared to other medications, including semaglutide. He stressed, however, that it was difficult to speculate on how durable weight loss from the drug might be. The best data currently available involves type 2 diabetes patients who started Mounjaro before the company’s savings card changes last fall. “Mounjaro persistency for those patients is tracking higher than those patients that were started on Trulicity and Ozempic (semaglutide) over that same period of time,” he said. “So while it’s too early to project the average length of therapy or how many out of 100 will still be on therapy after a couple of years, I think this early data is encouraging. As for obesity, time is going to tell.”

Filed Under: Metabolic disease/endicrinology