Photo by John Guccione www.advergroup.com: https://www.pexels.com/photo/100-us-dollar-banknotes-3531895/

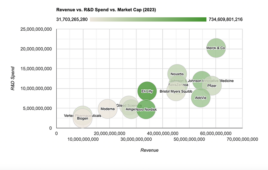

The obesity drug market has seen a surge of interest recently, largely thanks to the popularity of glucagon-like peptide-1 (GLP-1) drugs like Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro. The explosion in interest in the drug class has fueled the stock prices of Novo and Lilly, which both have multiple GLP-1 drugs in their portfolios.

Novo’s stock on the New York Stock Exchange is up over one-third so far in 2023 — trading near $92 per share after beginning the year at $68.48. Lilly has seen even steeper gains with its stock closing at $538.29 on October 2, up almost 48% so far this year.

So far this year, the GLP-1 surge has negatively impacted the stocks of some medical device companies focused on diabetes and sleep apnea. Analysts have even speculated that the surge in popularity could be good for airlines as slimmer passengers could save major airlines tens of millions annually.

An overheated weight-loss drug market?

But some analysts are beginning to view GLP-1 drugs may be overblown, as Barron’s recently noted. Jefferies analyst Matt Taylor upgraded his rating for the insulin pump maker Insulet, arguing their valuation looks more realistic now considering GLP-1’s impact on diabetes rates appears to be relatively limited. Similarly Morgan Stanley analyst Patrick Wood views the recent dip in medical technology stocks owing to GLP-1 as excessive. He estimates that if 30% of Type-2 diabetes patients adopt GLP-1 drugs by 2027, there would only be a 4% dip in patients needing insulin. While Jefferies analyst Matt Taylor remains bullish on Insulet, Tandem Diabetes Care, and DexCom, Morgan Stanley analyst Patrick Wood believes it’s too early to upgrade his ratings on DexCom and Insulet.

A diversifying market

As the GLP-1 market heats up, it is also diversifying with smaller players such as Viking Therapeutics and Structure Therapeutics announcing clinical trial data. While the major players like Novo Nordisk and Lilly currently dominate the obesity drug space with their GLP-1 drugs, emerging competitors aim to differentiate through novel mechanisms of action and improved efficacy.

Viking Therapeutics, for instance, is developing VK2735, a dual GLP-1/GIP agonist that aims to achieve greater weight loss through the synergistic effects of dual agonism. The company bets this approach could lead to more significant and sustained weight loss compared to mono-agonist drugs. In addition, Structure Therapeutics’ GSBR-1290 has shown impressive short-term weight loss, but its long-term trajectory as a mono-agonist remains uncertain.

A recent investor note from Truist notes that, while initial weight loss results from GLP-1 drugs like GSBR-1290, are impressive, the long-term efficacy of these drugs is unclear. Mono-agonists, despite supporting impressive initial weight loss, tend to plateau around week 40. This trend limits the overall potential weight loss to approximately 12–13%, Truist observes. Conversely, dual and triple agonists exhibit a more prolonged efficacy, with their effects plateauing around week 60.

Filed Under: Metabolic disease/endicrinology