[Feng Yu/Adobe Stock]

Far-ranging GLP-1 landscape projections

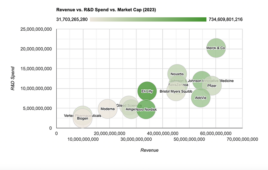

Given the massive potential of the obesity drug market, with projections ranging from Goldman Sachs’ $44 billion to Barclays’ $100 billion by 2030, Big Pharmas such as Novo Nordisk and Lilly are engaging in billion-dollar acquisitions of smaller biotechs with promising obesity pipelines.

At present, Novo Nordisk is having troubling keeping up with the surging appetite for Wegovy. Supply shortages, expected to continue into 2024, could allow rivals to seize market share with their own drugs targeting similar mechanisms of action.

While Novo Nordisk and Lilly are the most prominent players, they are not alone. As the table shows, the GLP-1 landscape covers an growing range of players.

An overview of key players in the market

| Drug/Brand | Developer | Indication | Notes |

|---|---|---|---|

| Semaglutide/Wegovy | Novo Nordisk | Obesity/Overweight and Type 2 Diabetes | Approved for the treatment of adults with obesity or overweight and for type 2 diabetes |

| Liraglutide/Saxenda | Novo Nordisk | Obesity | Daily injectable for obesity. Approved for obesity in late 2014. Approved for pediatric obesity in July 2020. |

| GSBR-1290 | Structure Therapeutics | Obesity (under study) | Oral GLP1 agonist. |

| VK2735/Viking Therapeutics | Viking Therapeutics | Obesity (under study) | In 2022, Viking initiated a phase 1 study of its GLP-1/GIP dual agonist in healthy volunteers. |

| Orforglipron | Eli Lilly | Obesity (under study) | Positive Phase 2 results published, showing significant weight loss compared to placebo. |

| Retatrutide | Eli Lilly | Obesity (under study) | Phase 2 results published in NEJM in October 2022. The triple incretin drug showed 22% placebo-adjusted weight loss. |

| AMG133 | Amgen | Obesity (under study) | In the phase 1 clinical study, the novel dual agonist demonstrated weight loss and improved glucose homeostasis. AMG133 is. a GLP-1 agonist fused to a GIPr antagonist. |

| GL0034 (utreglutide)/Utreglutide | Sun Pharma | Treatment of type 2 diabetes and obesity | The novel GLP-1 receptor agonist was the focus of a phase 1 in which it reduced body weight by 6.8%. |

| danuglipron | Pfizer | Adults with Obesity and Type 2 Diabetes Mellitus | A phase 2b study is underway in obesity patients. |

Filed Under: Metabolic disease/endicrinology