[Andrey Popov/Adobe Stock]

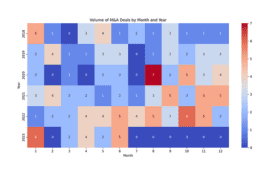

As interest rates have risen in 2023, pharma deal-making has remained strong although the deal size has dipped. As rates surpassed 2.4% from September 2022 onwards, deal activity jumped to an average of roughly 6 deals per month. For context, when interest rates ranged from 1.4% to 2.4% from 2018 to 2019, the industry averaged roughly 2 deals per month. While there was a relative increase in M&A volume during the historically low-interest period of 2020 to August 2022 when rates dropped to as low as 0.05%, the average number of deals per month then — 3.3 — is still markedly lower than recent levels.

One possibility is that higher interest rates are spurring companies to accelerate M&A activities before rates climb even higher, fueling a short-term spike in M&A deals. Simultaneously, the choppy biotech market has eroded the valuation of many promising players in the sector, making them into attractive targets for strategic acquisitions. In any case, the trend towards smaller deals is clear. While the frequency of deals has tripled from September 2022 onwards compared to the period of low interest rates during 2018 to 2019, the average deal size has consistently remained at $2.34 billion since 2020. Assessing the average deal size, however, is tricky given that many transactions in the industry do not publicly disclose the total consideration. That fact can potentially skew the perceived average.

Falling deal volumes since mid-2023

Deal volume, however, has slid since peaking in June 2023. In the following months, deal volumes have declined while while transaction sizes have fluctuated with a significant drop in August 2023. While there was a surge in deal transaction earlier in 2023, it was notably higher in 2019 — especially in the month of January when it hit $82 billion.

So far in October, there has been one notable acquisition. Lilly signaled its intent to scoop up Point Biopharma for $1.4 billion. The acquisition target is on the verge of announcing results of a major oncology trial.

Heightened FTC scrutiny and a surge in pharma M&A volume

Another counterintuitive trend is statistically significant increase in deal volume following Federal Trade Commission’s (FTC’s) announcement on May 16, 2023 that it would sue to block Amgen’s $27.8 billion acquisition of Horizon Therapeutics. (FTC and Amgen settled in September.) Specifically, the monthly deal volume jumped from an average of four deals in the three months before the announcement to nine deals in the three months after.

More predictably, however, there was a dip in the average deal size of pharma M&A following the FTC announcement. Deal size dipped from approximately $9 billion in the three months preceding the announcement to about $1.5 billion in the three months after. The shift in deal size, however, was not statistically significant.

FTC’s proposal of new antitrust merger guidelines in July 2023 coincided with a pronounced dip in M&A deal volume. This drop, however, coincided with a surge in the average deal size.

The tech sector also hasn’t been immune to FTC’s increased scrutiny. Recent lawsuits against giants, including Google and Amazon, highlight the agency’s approach to tackling anticompetitive practices broadly.

The chart below shows trends in pharma M&A activity throughout 2023, reflecting pertinent FTC milestones for the pharma sector. The graph charts both the monthly M&A deal volume average deal size. Factors skewing deal volume in early 2023 include Pfizer’s acquisition of Seagen in March for $43 billion, and Merck’s acquisition of Prometheus Biosciences in April for $10.8 billion.

As 2023 draws to a close, interest rates are projected to remain elevated. Recent interest rate hikes have corresponded to increases in M&A deal-making roughly one month after announcements. In light of this, M&A activity is anticipated to remain robust in the coming months but likely below the peak seen in June 2023. The average transaction size could also remain resilient if recent months are any indication. Since July 2023, the average transaction size begun a modest uptick, possibly setting the stage for a similar trend in the coming months.

The industry, however, is worried about a more intense antitrust scrutiny. More than 30 industry players, among them Amgen, Gilead, AbbVie and Merck, have created an initiative known as the Partnership for the U.S. Life Science Ecosystem (PULSE), which aims to raise awareness about the importance of M&A in life sciences.

Filed Under: Drug Discovery, Pharma 50, Regulatory affairs