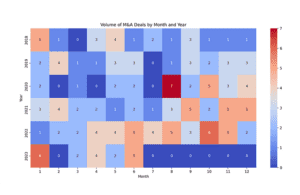

M&A deal-making has warmed after cooling during portions of the beginning of the pandemic.

The pharma industry in 2023 has been marked by an uptick of M&A activity. The year began with a relative frenzy of massive mergers. Pfizer’s $43 billion acquisition of Seagen and Amgen’s $27.8 billion purchase of Horizon Therapeutics earlier in the year were notable examples. But that initial spike of billion-dollar megamergers significantly cooled in the second quarter.

Looking at the M&A activity in pharma, the deal size of transactions in Q2 2023 were notably smaller, too. Check out the heat map of deal size below. The largest M&A transaction in the second quarter of the year was Novartis’s $3.2 billion acquisition of Chinook Therapeutics. This trend indicates that companies are prioritizing smaller, more strategic acquisitions to diversify their portfolios.

Thus far in Q3 2023, one of the notable transactions includes Lilly’s proposed purchase of Versanis, a private clinical-stage biopharma specializing in cardiometabolic diseases, for $1.925 billion. This deal would continue the trend of strategic acquisitions, with a focus on diversifying portfolios.

Heatmap of the total deal size by month and year of pharma M&A deals. Some of the largest deals in this time-frame include Takeda’s acquisition of Shire for $62B on May 7, 2018. Bristol Myers Squibb followed by acquiring Celgene for $74B on January 3, 2019, and AbbVie expanded its portfolio by buying Allergan for a hefty $63B on June 25, 2019. AstraZeneca made a significant move by buying Alexion Pharmaceuticals for $39B on December 12, 2020. Most recently, Pfizer acquired Seagen for $43B on March 13, 2023.

Deals could pick up in the second half of 2023, as PwC has projected, thanks to shrinking price gaps between buyers and sellers. But companies remain cautious on big transactions amid heightened regulatory scrutiny.

In terms of M&A activity in pharma Q2 2023, Moody’s highlights some of the key drivers in a gated report. It notes that pending patent expirations could drive companies to pursue acquisitions to find innovative products and technologies. In particular, smaller biotech companies with promising pipelines but lower equity valuations may become attractive targets.

Key M&A activity in pharma in Q2 2023

Lilly to scoop up Sigilon

On June 29, Eli Lilly announced it planned to acquire Sigilon, a biopharma developing encapsulated cell therapies, for $34.6 million. After announcing the news, Sigilon’s stock jumped 691.1% on the morning of June 29, 2023.

The deal aims to advance SIG-002, an investigational therapy that could provide long-term insulin production and control of blood glucose levels in patients with type 1 diabetes. Lilly and Sigilon have worked together since 2018 to develop encapsulated cell therapies for diabetes.

Line graph showing the stock prices of Eli Lilly and Sigilon from January to July 2023. A vertical red line highlights the date of the acquisition announcement on June 29, 2023. The stock prices of both companies ticked up after the announcement.

Shionogi & Co. to acquire Qpex Biopharma

On June 26, Shionogi & Co. announced its plans to acquire Qpex Biopharma for $100 million upfront, with potential for additional payments.

This deal would expand Shionogi’s antimicrobial R&D capabilities with a novel ß-lactamase inhibitor. In addition to the $100 million upfront payment, Qpex shareholders will receive further milestone payments of up to $40 million upon meeting certain regulatory and development goals. Qpex will become a fully owned subsidiary of Shionogi, bringing its β-lactamase inhibitor, xeruborbactam, which is being developed for the treatment of drug-resistant Gram-negative bacterial infections. Shionogi will assume responsibility for the global development, production, and marketing of xeruborbactam.

Shionogi and Qpex Biopharma stock data. Data sourced from Yahoo Finance.

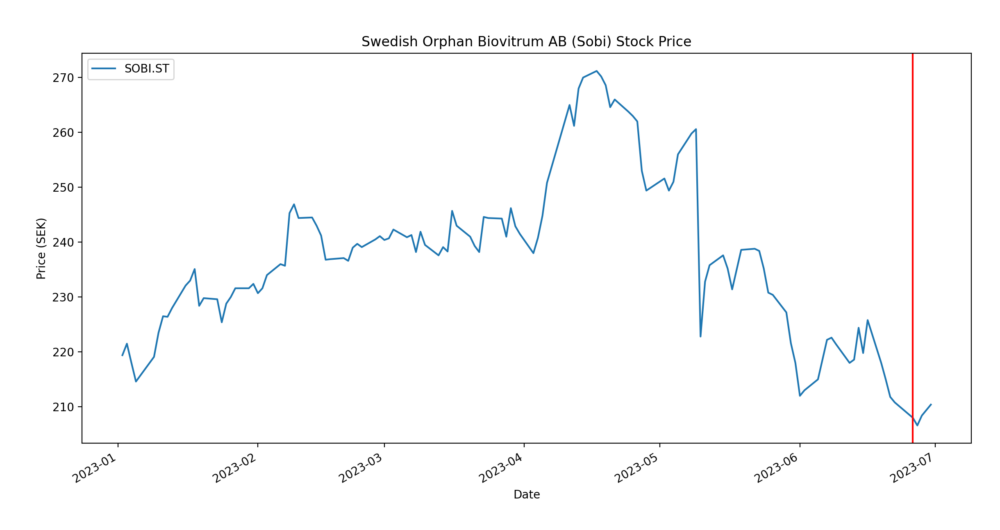

Swedish Orphan Biovitrum AB (Sobi) buys CTI BioPharma

On June 26, Swedish Orphan Biovitrum AB (Sobi) finalized a deal to acquire CTI BioPharma for $1.7 billion. Sobi says the deal will strengthens its hematology portfolio by giving it access to Vonjo (pacritinib), an oral kinase inhibitor that inhibits JAK2, IRAK1 and ACRV1, while sparing JAK1. The drug candidate received accelerated approval from the FDA in February 2022 for treatment of adults with intermediate or high-risk primary or secondary myelofibrosis and a platelet count below 50 × 109/L.

Swedish Orphan Biovitrum AB (Sobi) Stock Price. The vertical red line indicates the acquisition announcement date of CTI BioPharma. Data sourced from Yahoo Finance.

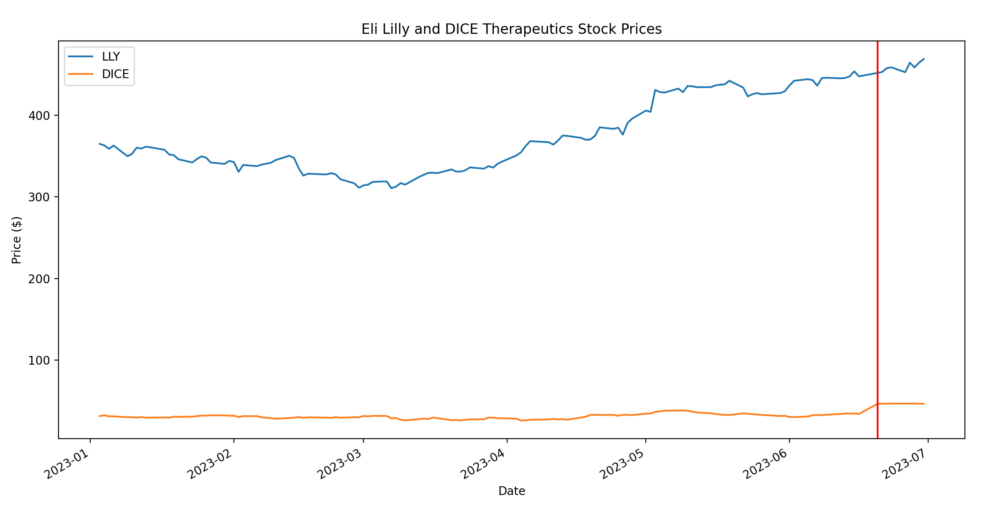

Lilly to purchase DICE Therapeutics

On June 20, Lilly has agreed to buy DICE Therapeutics for $2.4 billion in cash. The M&A transaction will give Lilly a boost in immunology thanks to DICE’s proprietary DELSCAPE technology platform and its oral IL-17 inhibitors. After the announcement came out, DICE Therapeutics’ stock jumped 38%.

Comparison of Eli Lilly (LLY) and DICE Therapeutics (DICE) stock prices. Data sourced from Yahoo Finance.

Merck & Co. wraps up its acquisition of Prometheus Biosciences

On June 16, Merck & Co. wrapped up its acquisition of Prometheus Biosciences for $10.8 billion, a strategic addition to its gastrointestinal therapeutics. The move strengthens Merck’s pipeline with a novel candidate for ulcerative colitis, Crohn’s disease and other autoimmune conditions. After Merck made the announcement, shares of Prometheus Biosciences surged 70% in premarket trading. Merck paid $200 per share in cash for Prometheus.

Stock price performance of Merck & Co. and Prometheus Biosciences around the completion of their acquisition agreement. The acquisition was completed on June 16, 2023.

Novartis agrees to acquire Chinook Therapeutics

On June 12, Novartis agreed to acquire Chinook Therapeutics in a deal worth up to $3.5 billion. The deal bolsters Novartis’ late-stage development pipeline for rare kidney disease treatments with two high-value, late-stage assets in development for IgA nephropathy (IgAN). Novartis paid at least $40 per share for Chinook, a premium of 67% more than its closing price on the previous trading day.

Stock price performance of Novartis and Chinook Therapeutics depicting the announcement of their acquisition agreement.

Gurnet Point Capital and Novo Holdings to acquire Paratek Pharmaceuticals

On June 6, Gurnet Point Capital and Novo Holdings agreed to acquire Paratek Pharmaceuticals for around $123 million plus an additional $49 million in contingent value rights. This acquisition will accelerate the commercialization of NUZYRA, a novel antibiotic.

Stock price performance of Paratek Pharmaceuticals following the announcement of their acquisition agreement with Gurnet Point Capital and Novo Holdings. The acquisition was announced on June 6, 2023.

Ironwood Pharmaceuticals to acquire VectivBio

On May 22, Ironwood Pharmaceuticals completed a tender offer for VectivBio for $1.145 billion. This acquisition could improve Ironwood’s position in the GI healthcare sector with the addition of VectivBio’s portfolio. It will give Ironwood VectivBio’s portfolio, including apraglutide, a next-gen synthetic GLP-2 analog in Phase 3 for short bowel syndrome with intestinal failure (SBS-IF).After the announcement, Ironwood Pharmaceuticals’ stock dropped roughly 15% in pre-market trading.

Stock price performance of Novartis and Chinook Therapeutics. The acquisition was made public on June 12, 2023. Data sourced from Yahoo Finance.

Astellas Pharma acquires Iveric Bio

On April 30, Astellas Pharma agreed to acquire Iveric Bio for $5.9 billion. This expands Astellas’ portfolio with Iveric Bio’s ophthalmic solutions. The deal gives Astellas access to avacincaptad pegol (ACP), a program for geographic atrophy (GA) secondary to age-related macular degeneration (AMD).

Stock price performance of Astellas Pharma and Iveric Bio. The acquisition was announced on April 30, 2023. Data sourced from Yahoo Finance.

Sanofi snaps up Provention Bio

On April 27, 2023, Sanofi finalized its acquisition of Provention Bio for $2.9 billion. This deal bolsters Sanofi’s portfolio with Provention’s pipeline of immune-mediated disease treatments.

Sanofi entered into an agreement to acquire Provention Bio on March 13, 2023. The deal will expand Sanofi’s portfolio of immune-mediated disease treatments with TZIELD (teplizumab-mzwv), the first disease-modifying treatment for the delay of Stage 3 type 1 diabetes (T1D). The drug has a price tag close to $200,000.

Sanofi’s stock is up considerably after announcing the acquisition of Provention Bio. The acquisition, announced on March 13, 2023, cannot be directly correlated with Provention Bio’s stock performance as it was delisted. Data sourced from Yahoo Finance.

Assertio Holdings agrees to buy Spectrum Pharmaceuticals

On April 25, Assertio Holdings agreed to acquire Spectrum Pharmaceuticals for $248 million plus an additional $43 million in contingent value rights. The transaction aims to improve the profitability of Rolvedon (eflapegrastim-xnst) injection and diversify revenue streams.

Assertio Holdings (ASRT) and Spectrum Pharmaceuticals (SPPI) Stock Prices. The vertical red line indicates the acquisition announcement date. Data sourced from Yahoo Finance.

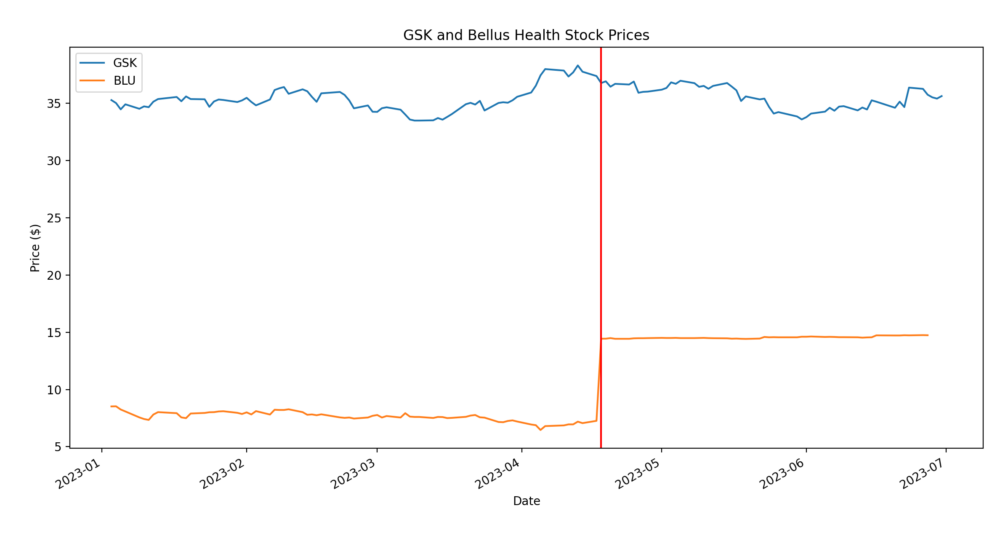

GSK to acquire Bellus Health

On April 18, GSK entered into an agreement to acquire Bellus Health for $2 billion. This acquisition adds Bellus Health’s chronic cough treatment to GSK’s portfolio.

The $2 billion deal aimed to strengthen GSK’s specialty medicines and respiratory pipeline with camlipixant, a highly selective P2X3 antagonist and potentially best-in-class treatment for refractory chronic cough (RCC).

Line graph showing the stock prices of GSK and Bellus Health from January to July 2023. A vertical red line highlights the date of the acquisition announcement on April 18, 2023. The stock price of Bellus Health surged immediately after the announcement while GSK’s stock price remains mostly flat. Data sourced from Yahoo Finance.

Filed Under: Drug Discovery and Development, Pharma 50, Special Feature