[Alpha Tauri 3D/Adobe Stock]

In the spotlight is the FDA’s Accelerated Approval program, which has faced criticism following a string of high-profile cases of post-approval confirmatory trial failures. For example, the Alzheimer’s drug aducanumab won accelerated approval despite conflicting evidence from clinical trials. Oncology is another area where negative confirmatory trials of accelerated approval drugs has been a concern.

Such developments have led the FDA to increase scrutiny of confirmatory trial data and timelines, adding an extra layer of complexity to an already rigorous approval process. Consequently, several promising biologic candidates that seemed poised for regulatory approval have recently received complete response letters from the FDA citing insufficient evidence or the need for further study.

As regulators scrutinize confirmatory data more closely, the fate of some promising biologics remains unclear as 2023 draws to a close.

1. Donanemab: Eli Lilly and Company

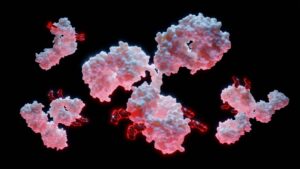

Donanemab is a humanized IgG1 monoclonal antibody from Lilly for early-stage Alzheimer’s disease. Like other drugs lecanemab, donanemab and aducanumab, the drug aims to eliminate amyloid plaques, which are a key characteristic of Alzheimer’s.

- Clinical trial efficacy: Completed a clinical trial with 257 early-stage Alzheimer’s disease participants to observe effects after 76 weeks of treatment. The confirmatory Phase 3 TRAILBLAZER-ALZ 2 trial showed robustly positive topline data, slowing cognitive decline by about one-third.

- Known safety profile: In clinical trials, donanemab demonstrated a safety profile with some patients experiencing infusion reactions such as chills, flushing, dizziness, rash and fever, and around one in four developing mostly asymptomatic ARIA-E, a type of brain swelling.

- Market potential: UBS projects that it could generate up to $4.8 billion in sales.

- Regulatory status: In January, however, the drug got a complete response letter from FDA for its accelerated approval submission, leaving Lilly to pursue traditional approval.

2. Bimekizumab (Bimzelx): UCB

The first dual IL-17 A/F inhibitor focused on moderate to severe plaque psoriasis, Bimekizumab, also known as Bimzelx, is a humanized bispecific IgG1 monoclonal antibody.. In the EU, it is authorized for psoriatic arthritis, axial spondyloarthritis and ankylosing spondylitis. The drug candidate was highlighted our roundup of potential blockbusters.

- Clinical trial phase: Completed phase 3 trials demonstrating superior levels of skin clearance compared to placebo, ustekinumab and adalimumab.

- Known safety profile: The drug candidate had an acceptable safety profile. In a phase 3 study, bimekizumab has displayed promising results in terms of both efficacy and safety, with an acceptable safety profile.

- Market potential: As the first dual IL-17 A/F inhibitor for moderate to severe plaque psoriasis, bimekizumab has strong market potential. Jeffries expects the drug to ultimately fetch $2 billion.

- Regulatory status: Now commercialized in the E.U.. In the U.S., bimekizumab received a complete response letter in May 2022 based on pre-approval inspection observations. At that time, UCB said it expected an FDA review by the second quarter of 2023.

Mirikizumab: Eli Lilly

Mirikizumab is a monoclonal antibody targeting the p19 subunit of interleukin-23 (IL-23). It is potentially the first-in-class treatment for ulcerative colitis and third-in-class treatment for Crohn’s disease. The drug candidate was also included in our roundup of potential blockbusters.

- Clinical trial phase: In Lilly’s phase 3 LUCENT-1 study, mirikizumab demonstrated significant effectiveness, with nearly two-thirds of patients responding to treatment at 12 weeks.

- Known safety profile: The FDA has expressed no concerns regarding the safety based on the clinical data package.

- Market potential: Given the chronic nature and prevalence of ulcerative colitis, Mirikizumab could gain a significant market share if approved. SVB Securities analyst David Risinger sees peak annual sales of up to $2 billion.

- Regulatory status: Received a complete response letter from FDA in April 2023 based on citing concerns related to the proposed manufacturing of the drug. There were no concerns about the clinical data package, safety or drug label.

Ryoncil (remestemcel-L): Mesoblast

Ryoncil, also known as remestemcel-L, developed by Mesoblast is an adult allogeneic, bone-marrow-derived mesenchymal stem cell treatment.

- Clinical trial phase: Ryoncil has undergone several clinical trials, including a phase 3 study known as REFLECT that evaluated its efficacy and safety in patients with acute GVHD. The drug has been won Priority Review from the FDA.

- Known safety profile: Ryoncil (remestemcel-L) is a suspension of ex-vivo cultured adult human mesenchymal stem cells intended for intravenous infusion. It has had a tolerable safety profile in studies.

- Market potential: Given its application for SR-aGVHD, a potentially life-threatening condition with limited treatment options, Ryoncil could address a significant unmet medical need.

- Regulatory status: The FDA PDUFA date for approval in graft-versus-host disease is on August 2, 2023.

5. Concizumab: Novo Nordisk

Concizumab is under consideration for approval in treating hemophilia A and B and has completed Phase 3 clinical trials.

- Clinical trial phase: Concizumab has completed Phase 3 clinical trials (explorer7 study) for the treatment of hemophilia A and B with inhibitors.

- Known safety profile: Concizumab has a generally favorable safety profile, with most adverse events reported in clinical trials being mild to moderate. But like any anticoagulant therapy, concizumab carries a risk of causing excessive bleeding.

- Market potential: Given the high unmet medical need in the hemophilia market, concizumab could capture a significant share of this market, particularly among patients with inhibitors.

- Regulatory status: Anticipated approval date for Hemophilia A and B is on September 1, 2023.

Pozelimab: Regeneron Pharmaceuticals

Pozelimab is an investigational fully human monoclonal antibody designed by Regeneron Pharmaceuticals to block the activity of complement factor C5, a protein involved in complement system activation. Regeneron is developing the drug is for CHAPLE disease (CD55 deficiency with hyperactivation of complement, angiopathic thrombosis and Protein Losing Enteropathy), a rare hereditary immune disease caused by overactivation of the complement system.

- Clinical trial phase: The FDA has accepted the Biologics License Application (BLA) for pozelimab for Priority Review.

- Known safety profile: In a healthy volunteer study, pozelimab was generally well tolerated while providing complete inhibition of ex vivo-assessed hemolytic activity. In another study, researchers found no serious adverse events or adverse events leading to treatment discontinuation. Common treatment-emergent adverse events included headache and nausea.

- Market potential: Considering that CHAPLE is an ultra-rare disease, Pozelimab could have a monopoly in this niche market upon approval, providing a unique opportunity for significant market capture.

- Regulatory status: FDA decision expected on August 20, 2023.

7. Lumevoq: GenSight Biologics

Lumevoq is a gene therapy product from GenSight Biologics for the treatment of Leber hereditary optic neuropathy (LHON) caused by a mutated ND4 gene. LHON is a rare mitochondrial disease that leads to irreversible blindness. It mainly affects teens and young adults.

- Clinical trial phase: Lumevoq has undergone three phase 3 clinical trials: RESCUE, REVERSE and REFLECT.

- Known safety profile: Favorable, as determined in the aforementioned phase 3 studies.

- Market potential: In France, bilateral injections of Lumevoq have a price tag of €700,000 per patient and could generate revenues before regulatory approval and reimbursement.

- Regulatory status: GenSight Biologics initially expected an opinion from the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) by Q3 2023. In May 2023, the timeline for the EMA CHMP opinion was pushed to Q1 2024. Following that, the sponsor decided to pull its application ahead of a final opinion by the Committee for Advanced Therapies (CAT) of the CHMP of the EMA. This move allows the company to mull the best possible path forward for the drug with the EMA. It plans to file a new application addressing remaining regulatory objections in Europe and elsewhere.

Filed Under: Biologics, clinical trials, Drug Discovery, Regulatory affairs