[Image by kwanchaift/Adobe Stock]

This article considers 20 promising medications that could generate significant sales for the industry. From hypertension to cancer, Alzheimer’s to hemophilia, these novel therapies could potentially change the lives of millions worldwide.

About one-third of the novel therapies on this list are monoclonal antibodies. Gene therapies, antivirals and other drug types are also included.

1. Aprocitentan

Indication: Difficult-to-treat hypertension

Estimated peak sales: $2.5 billion

The investigational hypertension drug aprocitentan from Idorsia Pharmaceuticals (SWX:IDIA) is a dual endothelin receptor antagonist. By blocking the peptide endothelin, the drug can block the constriction of blood vessels, causing blood vessels to relax and leading to a decrease in blood pressure.

In 2017, Idorsia entered into a collaboration agreement with Janssen to develop the drug candidate for treatment-resistant hypertension. In late January 2022, Idorsia submitted for European authorization to market aprocitentan for treatment-resistant hypertension. Idorsia filed for FDA approval at the end of 2022.

2. Aflibercept (high-dose)

Indications: wAMD, DME, diabetic retinopathy

Sales (2022): $9.6 billion

Regeneron (Nasdaq:REGN) submitted a biologics license application to cover high-dose aflibercept (Eylea) for wet age-related macular degeneration (wAMD), diabetic macular edema (DME) and diabetic retinopathy in December 2022. The company used a priority review voucher when submitting the filing. On Feb. 23, Regeneron announced that the agency had accepted the priority review covering an 8 mg dose of aflibercept for the abovementioned conditions. The agency set a target action date of June 27, 2023.

[Image by rumruay/Adobe Stock]

3. Bimekizumab

Indication: Plaque psoriasis, psoriatic arthritis and axial spondyloarthritis

Estimated peak sales: $2 billion by 2027 (Clarivate)

[Image by designua/Adobe Stock]

Another hurdle is that the FDA handed the drug a complete response letter in May 2022 after visiting its Belgian manufacturing facilities. The company resubmitted its application afterward. FDA accepted the resubmission in December 2022.

In September 2022, European regulators accepted two marketing authorization applications for the drug for psoriatic arthritis and axial spondyloarthritis, respectively.

The company announced positive Phase 3 related to bimekizumab in hidradenitis suppurativa (HS), an inflammatory skin disease, in December 2022.

Other novel therapies in the company’s pipeline include rozanolixizumab, fenfluramine and doxecitine and doxribtimine.

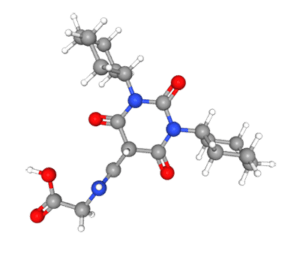

4. Capivasertib

Indications: Breast cancer

Estimated peak sales: $1+ billion by 2031 (Clarivate)

[Capivasertib image courtesy of PubChem]

5. Daprodustat

Indications: CKD-related anemia

Estimated peak sales: $0.53 billion by 2027 (Clarivate)

[Image courtesy of PubChem]

FDA approved the drug, also known as Jesduvroq, in February 2023 for adults on dialysis with anemia from chronic kidney disease.

GSK describes the drug as the “first innovative medicine for anemia treatment in over 30 years.”

Clarivate notes that the drug’s oral formulation, competitive pricing, high hemoglobin-raising efficacy and ability to lower the need for iron supplementation bode well for its uptake.

Daprodustat is also available in Japan.

6. Deucravacitinib

Indications: Plaque psoriasis

Projected sales: $2.12 billion by 2027 (Clarivate)

[Image courtesy of Bristol Myers Squibb]

In January 2023, Bristol-Myers Squibb announced that the European Union’s Committee for Medicinal Products for Human Use (CHMP) backed deucravacitinib for adults with moderate-to-severe plaque psoriasis.

Clarivate notes that deucravacitinib’s oral administration, efficacy and safety profile could set it apart from injectable erythropoiesis-stimulating agents used to treat plaque psoriasis.

7. Donanemab

Indication: Alzheimer’s

Estimated peak sales: $4.8 billion (UBS)

Lilly’s (NYSE:LLY) Alzheimer’s monoclonal antibody, donanemab, could receive traditional approval. In January 2023, FDA sent Lilly a complete response letter for the accelerated approval submission for the drug over concerns about the limited number of patients with at least 12 months of drug exposure data included in the submission.

Donanemab works by targeting amyloid plaques in the brain that are associated with Alzheimer’s disease. There are a growing number of novel therapies with a similar mode of action set to be available for Alzheimer’s in the near future that target amyloid. Their efficacy remains controversial for the time being, however.

FDA approved the first such antibody, aducanumab, in 2021.

8. Efanesoctocog alfa

Indication: Hemophilia A

Estimated peak sales: €2.3 billion (Barclays)

[image by denisismagilov/Adobe Stock]

9. Epcoritamab

Indication: Lymphoma

Estimated peak sales: $2.75 billion

By binding to CD20 on B-cells and CD3 on T-cells, epcoritamab can engage T-cells and redirect their activity toward B-cells. [Image courtesy of AbbVie]

10. Etrasimod

Indications: Ulcerative colitis and other inflammatory disorders

Estimated peak sales: $3 billion

Pfizer’s (NYSE:PFE) S1P inhibitor has potential for various conditions, including ulcerative colitis, eosinophilic esophagitis, alopecia areata, Crohn’s disease and atopic dermatitis. Analysts predict annual sales to top $3 billion.

The signaling molecule S1P plays a role in regulating immune cell trafficking and function. Blocking the receptor could put the brakes on immune cells’ travel from lymph nodes to the bloodstream and target organs. That functionality enables it to curb inflammation and tissue damage.

11. Foscarbidopa and foslevodopa

Indications: Advanced Parkinson’s disease

Estimated peak sales: $0.88 billion by 2027 (Clarivate)

AbbVie’s foscarbidopa and foslevodopa could offer more convenient dosing than other Parkinson’s disease therapies. While oral levodopa remains a cornerstone of Parkinson’s treatment, its limited therapeutic window and short half-life can limit symptom control. The combination of foscarbidopa and foslevodopa, also known as ABBV-951, could thus help meet the needs of patients with significant unmet needs. The therapy could also prove to be superior to orally-administered carbidopa-levodopa. AbbVie studied ABBV-951 in a 12-week Phase 3 trial, concluding that recipients of the drug combination had a 2.7 increase in “on” time, in which symptoms are well-controlled, compared to the oral control cohort. In addition, clinical trial investigators noted that the improvement remained evident after one week and persisted throughout the study.

[Image by ipopba/Adobe Stock]

12. Lecanemab

Indication: Alzheimer’s

Estimated peak sales: $9 billion (consensus estimate)

At the beginning of 2023, the FDA granted accelerated approval for Leqembi (lecanemab), a medication for Alzheimer’s developed by Eisai (OTCMKTS:ESALY) and Biogen (Nasdaq:BIIB). Despite being expected to outsell Aduhelm, the drug has met with a mixed response from the medical community and researchers owing to its steep cost, limited effectiveness, and potential side effects. The yearly cost for lecanemab is set at $26,500.

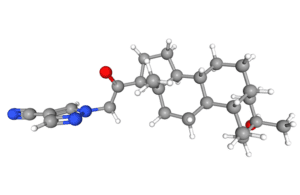

13. Lenacapavir

Indication: HIV

Projected peak sales: $1.50 billion (Morningstar)

Lenacapavir chemical structure [Image courtesy of Wikimedia Commons]

14. Mirikizumab

Indications: Ulcerative colitis and others

Estimated peak sales: $0.6 billion by 2027 (Clarivate)

The IgG4 monoclonal antibody mirikizumab (LY3074828) from Eli Lilly could ultimately find use in treating various inflammatory diseases. Examples include inflammatory bowel disease conditions, ulcerative colitis and Crohn’s disease. The interleukin-23 subunit p19 (anti-IL23p19) inhibitor mirikizumab also has shown promise in psoriasis, but Lilly has given up on developing mirikizumab for plaque psoriasis. As with guselkumab, tildrakizumab, risankizumab and stekinumab, mirikizumab targets the pro-inflammatory cytokine interleukin-23. In 2022, Lilly announced that half of the ulcerative colitis patients who received the drug in a Phase 3 study achieved remission at one year. In late 2021, the company declared that anti-IL23p19 was the first anti-IL23p19 to support the maintenance of clinical remission in a Phase 3 ulcerative colitis study. The company also noted that the antibody appeared to reduce bowel urgency in ulcerative colitis patients.

15. Nirsevimab

Indication: To prevent RSV

Estimated peak sales: $3 billion (Jefferies)

Photomicrographic detection of respiratory syncytial virus (RSV) via an indirect immunofluorescence technique [Image courtesy of CMS]

16. SRP-9001

Indication: Duchenne muscular dystrophy

Estimated peak sales: $3.6 billion (SVB Securities)

Sarepta Therapeutics has partnered with Roche to develop the gene therapy product SRP-9001 (delandistrogene moxeparvovec) for Duchenne muscular dystrophy (DMD). Currently, corticosteroids are the standard of care for treating the rare genetic disorder DMD. Unfortunately, the prognosis for the condition tends to be poor, and its symptom burden high, including progressive muscle weakness, problems walking, frequent falls and learning disabilities.

Mutations in the dystrophin gene are responsible for the condition. SRP-9001 deploys an adeno-associated virus serotype rh74 (AAVrh74) to shuttle a functional copy of the missing or defective dystrophin gene to muscle cells. The drug thus has the potential to restore the expression of functional dystrophin, which is essential for maintaining muscle integrity and preventing muscle damage. Accordingly, FDA has handed SRP-9001 Fast Track designation as well as Orphan Drug designation. FDA designates roughly one-third of novel therapies as Fast Track.

17. Teclistamab

Indications: Multiple myeloma

Estimated peak sales: $2 billion (SVB)

Janssen’s investigational monoclonal antibody teclistamab (Tecvayli) won accelerated approval from FDA in October 2022 for the treatment of multiple myeloma. The bispecific antibody teclistamab targets both BCMA (B-cell maturation antigen) and CD3, two proteins involved in cancer cell survival and growth. The approval covers patients who have received at least four prior rounds of treatment, including a proteasome inhibitor, an immunomodulatory agent and a monoclonal antibody targeting CD38. FDA has warned that the drug could lead to cytokine release syndrome (CRS) and neurologic toxicity. The agency has thus constrained its use to a Risk Evaluation and Mitigation Strategy (REMS) program known as Tecvayli REMS.

18. Teplizumab

Indications: Type 1 diabetes

Estimated peak sales: $2 billion (Illumination Capital)

Tzield from Provention Bio

Teplizumab from Provention Bio scored FDA approval in November 2022 for preventing or delaying type 1 diabetes in at-risk individuals. It is a monoclonal antibody that targets CD3, a protein involved in activating T-cells. By targeting CD3, teplizumab can reduce the immune system’s attack on insulin-producing beta cells in the pancreas, which is the underlying cause of type 1 diabetes.

Provention Bio (Nasdaq:PRVB) announced that the wholesale cost of a vial of Tzield is $13,850. Available as an intravenous infusion that is provided once daily for 14 consecutive days, a course of treatment of Tzield has an overall cost of $193,900.

FDA and European regulatory authorities have approved a growing number of monoclonal antibodies in recent years. In 2010, only a handful of the novel therapies won regulatory approval. In 2021, however, more than a dozen did, according to the Antibody Society.

19. Valoctocogene roxaparvovec

Indication: Hemophilia A

Estimated peak sales: $1.5 billion (BioMarin)

Another of the novel therapies in this list is valoctocogene roxaparvovec, a gene therapy developed by BioMarin Pharmaceutical for treating hemophilia A. It works by delivering a functional copy of the F8 gene — which encodes for clotting factor VIII — to liver cells using an adeno-associated virus vector. This allows for the sustained production of factor VIII, which is deficient in patients with hemophilia A.

Valoctocogene roxaparvovec has shown promising results in clinical trials, significantly reducing bleeding events observed in patients who received the gene therapy.

In 2020, however, BioMarin received a complete response letter for the BLA for the gene therapy. In October 2022, the company resubmitted the BLA for the therapy.

Valoctocogene roxaparvovec is administered as a one-time intravenous infusion and has the potential to offer a durable treatment option for patients with hemophilia A. The drug is undergoing further clinical trials to evaluate its safety and efficacy, and the results of these trials will determine its potential for regulatory approval and commercial success. The drug is expected to generate peak sales of around $1.5 billion, according to industry analysts.

20. Zuranolone

Indications: Major depressive disorder and postpartum depression

Estimated peak sales: $1.6 billion (Evaluate Pharma)

[Zuranolone image courtesy of PubChem]

The companies are a regulatory nod for zuranolone to treat both major depressive disorder (MDD) and postpartum depression (PPD).

The antidepressant market has seen an uptick in regulatory approvals for novel therapies in recent years. In July 2022, we surveyed a number of novel therapies for treating depression that could win regulatory approval in the relatively near term.

Filed Under: Cell & gene therapy, Drug Discovery, Special Feature