The pandemic has heightened interest in COVID-19 therapies, sometimes stealing attention from other pharmaceutical breakthroughs. But the pandemic has also served as a reminder that investment in new drugs can pay dividends while leading to a greater societal appreciation for the industry.

A 2019 study published in International Health concluded that pharmaceuticals that have launched since 1981 have made substantial gains in life expectancy. Without drug introductions between 1981 and 2013, mortality for those under 85 would have been 2.16 times higher, the study concluded.

Below is a survey of pipeline drugs that hold promise for treating conditions ranging from cancer to COVID-19 to diabetes.

Dermatology

Deucravacitinib 2-D structure. Image from the NIH’s PubChem.

1. Deucravacitinib: In April, Bristol Myers Squibb (NYSE:BMY) announced positive data from two pivotal Phase 3 studies investigating deucravacitinib as a treatment for moderate to severe plaque psoriasis.

Deucravacitinib is an oral selective tyrosine kinase 2 (TYK2) inhibitor.

The studies, known as POETYK PSO-1 and POETYK PSO-2, tested a daily dose of 6 mg of deucravacitinib. Both met both co-primary endpoints compared to placebo.

Bristol Myers Squibb also announced that deucravacitinib led to superior skin clearance compared with Otezla (apremilast) from Amgen, which had acquired that drug from Celgene in 2019 for $13.4 billion.

2. Roflumilast: The topical phosphodiesterase-4 (PDE4) inhibitor roflumilast for plaque psoriasis could be available in several markets in 2022, according to a prediction from GlobalData. The investigational drug from Arcutis Biotherapeutics has fared well in its pivotal DERMIS-1 and DERMIS-2 trials. “In the announced clinical trial results, roflumilast cream was generally safe and well-tolerated. In fact, 90% of patients within the randomized roflumilast treatment arm completed a full eight weeks,” said Tiffany Chan, immunology analyst at GlobalData. While the drug holds promise for plaque psoriasis, it would enter a crowded therapeutics space and would be the second PDE4 inhibitor after Otezla (apremilast) from Amgen. Unlike the tablet-based Otezla, however, roflumilast is a topical cream.

Diabetes and metabolic syndrome

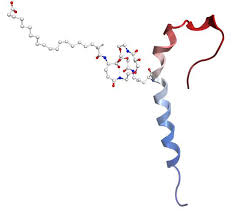

The tirzepatide molecule is a 39 amino acid linear peptide conjugated to a C20 fatty acid moiety. Tirzepatide image from Lilly.

3. Tirzepatide: Tirzepatide (LY3298176) from Eli Lilly (NYSE:LLY) is an experimental, once-weekly dual glucose-dependent insulinotropic polypeptide that performed better than the injectable anti-diabetes drug semaglutide in the recent SURPASS clinical trial. In the study, tirzepatide achieved superior A1C and body weight reductions across three doses compared to injectable semaglutide in adults with type 2 diabetes. Results were most pronounced for participants receiving the highest dose of tirzepatide (15 mg). This subgroup saw A1C values drop –2.46% from a baseline of 8.28%. A total of 45.7% of participants receiving 15 mg of tirzepatide achieved normal A1C values. A1C readings of 6.4% or higher are diabetic, while readings below 5.7% are normal. Patients receiving 15 mg of tirzepatide and counseling on lifestyle intervention also lost an average of 27 pounds or 13% of their body weight.

More recent results from the SURPASS-4 study showed tirzepatide was superior to titrated insulin glargine in improving A1C values and reducing body weight in adults with type 2 diabetes with increased cardiovascular disease risk.

Lilly reported that it plans on submitting the registration package to regulatory authorities by the end of the year.

4. Setmelanotide: Rhythm Pharmaceuticals (NSDQ:RYTM) is developing the drug setmelanotide to treat obesity. The investigational drug has shown promise in curbing hunger with confirmed loss-of-function biallelic proopiomelanocortin (POMC), including PCSK1, deficiency or biallelic leptin receptor (LEPR) deficiency in adults and children six years old and older. The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) recently issued a positive opinion for setmelanotide for this indication.

Gastroenterology

5. Mirikizumab: Lilly announced in March that the monoclonal antibody mirikizumab (LY3074828) met the primary and all key secondary endpoints in an ulcerative colitis Phase 3 study known as LUCENT-1. The 12-week multicenter induction study evaluated the drug as a potential treatment for moderate to severe ulcerative colitis. The humanized monoclonal antibody binds to the p19 subunit of interleukin-23 (IL-23p19). Interleukin-23 is a proinflammatory cytokine. Lilly boasted in March that LUCENT-1 was the only Phase 3 trial involving an anti-IL-23p19 monoclonal antibody that led to reduced bowel urgency in patients with moderate to severe ulcerative colitis. Lilly is also exploring the potential of mirikizumab to treat Crohn’s disease.

6. Larazotide: 9 Meters Biopharma (NASDAQ:NMTR) launched a Phase 3 trial for its larazotide acetate (INN-202) in people with celiac disease whose symptoms do not resolve with a gluten-free diet alone. The condition, known as non-responsive celiac disease, is associated with gastrointestinal symptoms, weight loss, small-intestinal damage or other symptoms in people who have followed a strict gluten-free diet for six to 12 months. The Raleigh, N.C.–based company designed larazotide acetate to repair multiprotein adhesions between small intestine cells known as “tight junctions.” Celiac disease causes these tight junctions to weaken, leading to an inflammatory cascade. 9 Meters Biopharma believes the drug could offer hope to other patients with celiac disease. If ingested before a meal, it could halt the intestinal-inflammatory process in response to gluten. The company anticipates the topline readout from the Phase 3 trial to occur in 2022.

9 Meters Biopharma believes Larazotide’s mechanism of action applies to multiple diseases. Image courtesy of 9 Meters Biopharma.

Hematology

7. Roctavian: In January, BioMarin Pharmaceutical announced positive results from its ongoing Phase 3 GENEr8-1 study of Roctavian (valoctocogene roxaparvovec), an experimental gene therapy for severe hemophilia A. The company boasted that the Phase 3 study is the largest to date for gene therapy, involving 134 participants. In Europe, the company intends to file a regulatory submission for the drug in June 2021. BioMarin plans to file a biologics license application with FDA in the second quarter of 2022, assuming future trial results are positive. Industry observers had expected Roctavian to win FDA approval in August 2020, but the agency pressed BioMarin to provide at least two years of follow-up data from the Phase 3 trial for the drug.

Infectious Disease

Cabenuva image courtesy of ViiV Healthcare

8. Cabotegravir: Cabotegravir is currently available as a combination therapy known as Cabenuva with Johnson & Johnson’s (NYSE:JNJ) rilpivirine. The therapy is available for oral and intramuscular use. The FDA indication for the drug is the treatment of HIV infection in people who are virologically suppressed. But the developer of cabotegravir, ViiV Healthcare, believes that cabotegravir could potentially be used to prevent HIV infection or as a pre-exposure prophylaxis. A joint venture of Pfizer, GSK and Shionogi, ViiV has started a rolling submission with FDA to expand the use of cabotegravir for HIV prevention. FDA has currently approved two oral drugs as a pre-exposure prophylaxis (PrEP) — Truvada (emtricitabine/tenofovir) and Descovy (emtricitabine/tenofovir) from Gilead Science.

Cabotegravir has the potential to be used as a long-acting injectable drug, making it well-suited for patients who struggle with swallowing or remembering to take a daily pill. Phase 3 data suggest that injectable cabotegravir administered once every two months is superior to oral emtricitabine/tenofovir when used as a PrEP. GlobalData projects that cabotegravir-based intramuscular therapies will make up the bulk of the injectable anti-HIV therapeutics market.

9. Lenacapavir: Gilead Science’s (NASDAQ:GILD) lenacapavir won FDA Breakthrough designation for HIV. In March, the company announced that the investigational HIV capsid inhibitor showed promise in the Phase 2/3 CAPELLA trial in heavily treatment-experienced people with multi-drug resistant HIV-1 infection. After investigators administered the drug subcutaneously every six months in the clinical trial, it demonstrated high rates of virologic suppression through 26 weeks. Almost three-quarters of participants (73%) had an undetectable viral load (less than 50 copies per mL).

Gilead is partnering with Merck (NYSE:MRK) to develop investigational treatment combinations of Gilead’s lenacapavir and Merck’s islatravir to treat HIV. The companies expect the first clinical studies to test such combinations to launch in the second half of 2021.

GlobalData estimates that sales of injectable anti-HIV therapeutics such as cabotegravir and lenacapavir to hit $2 billion by 2029.

10. Molnupiravir: Merck (NYSE: MRK) and Ridgeback Biotherapeutics are developing the antiviral molnupiravir for outpatient use for patients recently diagnosed with COVID-19. A recent Phase 2 study showed that the investigational drug reduced infectiousness in COVID-19 patients. Merck and Ridgeback Biotherapeutics are pursuing a Phase 3 clinical trial for non-hospitalized patients. A University of Alberta virology lab recently shed light on how the investigational drug disrupts SARS CoV-2 in a study published in the Journal of Biological Chemistry. Namely, the antiviral ramps up mutagenesis of SARS-CoV-2, speeding up replication errors in the virus. Researchers at the Emory Institute for Drug Development first discovered molnupiravir, which was previously known as EIDD-2801.

George Painter, the director of the Emory Institute for Drug Development, was involved in creating molnupiravir.

11. mRNA-1273.351: The second-generation mRNA-1273.351 COVID-19 vaccine from Moderna (NSDQ: MRNA) recently showed promise in a Phase 2 trial pitting it against the company’s currently authorized mRNA-1273 vaccine. In the trial, a booster dose of mRNA-1273.351 led to a higher neutralizing antibody response against the B.1.351 variant that first emerged in South Africa than mRNA-1273. Adverse events were also less from mRNA-1273.351 than mRNA-1273

12. siRNA-nanoparticle therapy for COVID-19: An experimental direct-acting antiviral therapy uses a unique strategy to halt viral replication. The gene-silencing RNA technology known as siRNA (small-interfering RNA) targets the SARS-CoV-2 genome. Lipid nanoparticles facilitate the delivery of siRNA to the lungs. According to Nigel McMillan, a professor and director of the Infectious Diseases & Immunology Program at Menzies Health Institute Queensland (MHIQ) in Australia, the virus-specific siRNA reduces viral load by 99.9% in a study involving mice.

Researchers from MHIQ and the research center City of Hope (Duarte, Calif.) developed the investigational therapy.

13. EXO-CD24: Developed by Tel Aviv’s Ichilov Medical Center, the experimental drug EXO-CD24 has shown promise in the Phase 1 trial, where it seemed to speed the recovery from COVID-19. In the study, 30 patients with moderate-to-severe COVID-19 received the inhalable drug. All recovered, and 29 of them did so within three to five days. Researchers at the Ichilov Medical Center in Israel designed the drug to stop the cytokine storm that can occur in some COVID-19 patients. A Phase 2 trial is launching in Greece.

Neurology

14. YTX-7739: YTX-7739 from Yumanity Therapeutics (NASDAQ:YMTX) could be a promising treatment for Parkinson’s. The investigational drug, the company’s lead candidate, improved motor skills and reduced toxic protein clumping in a preclinical study on mice. Yumanity developed the drug to combat alpha-synuclein pathology, which is a risk factor for Parkinson’s disease. “Our proprietary discovery platform led us to the target stearoyl-CoA desaturase (SCD), which, when inhibited, decreases the toxicity associated with pathogenic α-synuclein,” said Dan Tardiff, interim head of research and scientific co-founder at Yumanity, in a statement.

15. Donanemab: Eli Lilly’s (NYSE: LLY) donanemab has shown promise in a Phase 2 Alzheimer’s disease trial, slowing the rate of cognitive decline by approximately one-third compared with placebo. The TRAILBLAZER-ALZ study used the integrated Alzheimer’s Disease Rating Scale (iADRS) to measure cognition performance. While the investigational drug did not lead to outright improvement in cognitive performance, it is unique because it was successful at all. More than 400 Alzheimer’s drugs have failed in clinical trials. The NEJM summarized the trial results. Lilly also found that donanemab slowed the accumulation of tau proteins in brain regions in people with Alzheimer’s disease.

Oncology

16. Pirtobrutinib: An investigational, third-generation Bruton tyrosine kinase (BTK) inhibitor from Eli Lilly showed promise in treating relapsed or refractory B-cell malignancies in a Phase 1/2 study summarized in March in The Lancet. The recent study evaluated the drug previously known as LOXO-305 in 139 patients with chronic lymphocytic leukemia and small lymphocytic lymphoma. The overall response rate for a variety of pirtobrutinib doses was 63%.

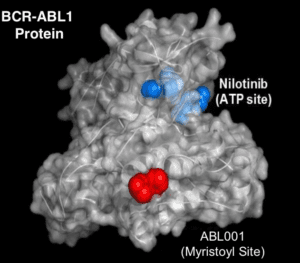

Asciminib image courtesy of the University of Adelaide

17. Asciminib: Novartis (NYSE:NVS) announced in February 2020 that the novel investigational treatment asciminib specifically targeting the ABL myristoyl pocket (STAMP) won breakthrough therapy designation (BTD) by FDA. The designation covers adult patients with Philadelphia chromosome-positive chronic myeloid leukemia (Ph+ CML).

18. Libtayo: Regeneron Pharmaceuticals’ (NSDQ:REGN) programmed cell death protein 1 (anti-PD-1) inhibitor Libtayo has shown promise in melanoma patients in a Phase 1 trial pairing the drug with fianlimab (REGN3767). Efficacy was highest in patients who had not received anti-PD-1 drugs previously. This cohort experienced a 64% objective response rate, including three complete responses and 18 partial responses in a pool of 33 patients. In a note to investors, Canaccord Genuity analyst John Newman wrote that he was impressed with a variety of clinical trial data related to Libtayo, noting that it fared admirably compared to Merck’s blockbuster Keytruda (pembrolizumab). “We are impressed by the efficacy profile for Libtayo versus Keytruda, which showed greater [progression-free survival] and [objective response rate] versus Keytruda. More so, we are impressed by two-year survival rates for patients among Libtayo versus Keytruda. Additionally, we find Libtayo data in patients with brain metastases impressive.”

19. AGEN1777: This first-in-class bispecific from Agenus blocks the immune receptor known as T cell immunoreceptor with Ig and ITIM domains (TIGIT) and a second undisclosed target. In late preclinical development, AGEN1777 has shown promise in tumor models resistant to anti-PD-1 or anti-TIGIT monospecific antibodies alone. Bristol Myers has signed up to partner with Agenus to license the anti-TIGIT drug.

20. Relatlimab: A LAG-3–blocking investigational antibody from Bristol Myers Squibb (BMS) doubled the median progression-free survival rate when used with Opdivo (nivolumab) in melanoma patients, the popular immunotherapy from the same company. The Phase 2/3 study known as RELATIVITY-047 pitted Opdivo/relatlimab against Opdivo monotherapy as a first-line treatment. The promising data could pave the way for an alternative to the pairing of Opdivo with Yervoy (ipilimumab), another immunotherapeutic agent that is “highly efficacious but comes with side effect baggage that can lead to treatment discontinuations or physicians avoiding the combination in favor of monotherapy with Opdivo or other anti-PD-1s as well as non-IO regimens,” as Gregg Gilbert, a Truist analyst explained in a briefing note.

AGEN1777 along with AGEN1327 were featured in a SEC report from Agenus.

21. Teclistamab: Formerly known as JNJ-64007957, teclistamab from Johnson & Johnson demonstrated a favorable safety and efficacy in an ongoing Phase 1 study (NCT03145181) for people with relapsed and refractory multiple myeloma, cancer involving a type of white blood cells. The objective response rate for the drug in heavily pretreated patients was 73% at the recommended dose for a subcutaneous formulation of the drug. Earlier intravenous formulations of the drug also showed promise. A Phase 2 registration trial for the drug has also begun.

22. Ciltacabtagene autoleucel (cilta-cel): In December 2020, Janssen announced promising results from its combined Phase 1b/2 CARTITUDE-1 study investigating ciltacabtagene autoleucel (cilta-cel) as a potential treatment for heavily pretreated patients with multiple myeloma. The drug is an investigational B cell maturation antigen (BCMA)-directed chimeric antigen receptor T cell (CAR-T) therapy.

23. Ziltivekimab: The investigational interleukin-6 (IL-6) inhibitor ziltivekimab from Novo Nordisk (CPH: NOVO-B) recently hit a primary endpoint in a Phase 2 trial in patients with advanced chronic kidney disease and high cardiovascular risk. In a separate trial, the experimental drug reduced inflammation in treating anemia in patients on hemodialysis. The drug was first known as COR-001 and was developed by Corvidia Therapeutics, which Novo Nordisk acquired in 2020.

24. NM21-1480: Numab Therapeutics AG (Wädenswil, Switzerland) has emerged as a leading developer of trispecific antibodies, which simultaneously target cancer cells, a receptor activating T cells and a T-cell protein. Its lead candidate NM21-1480 is a trispecific antibody that works as both a PD-L1 inhibitor and 4-1BB (CD137) agonist. In early in vivo studies, the molecule has shown potent anti-tumor activity. Numab recently raised CHF100 million ($111 million) in funding to support the development of the drug.

Ophthalmology

25. Sepofarsen: An investigational antisense oligonucleotide sepofarsen from ProQr led to durable vision improvements in people with a genetic eye condition known as Leber congenital amaurosis type 10 in clinical studies. The company has a Phase 2/3 clinical trial in progress for the experimental drug involving 36 participants. Research in 2018 at the University of Pennsylvania found that sepofarsen injections delivered every three months yielded continued vision improvement in 10 study participants.

Filed Under: clinical trials, Drug Discovery, Immunology, Infectious Disease, Neurological Disease, Oncology, RD