[Image courtesy of ipopba/Adobe Stock]

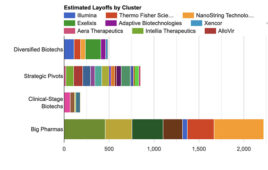

But Big Pharma companies continue to see more job cuts in terms of raw numbers. Several pharma giants have announced multiple waves of layoffs from 2022 to present, including Biogen (8 layoff announcements), Pfizer (6 layoffs), Novartis (5 layoffs) and Bayer, Zymergen, Bristol Myers Squibb, Johnson & Johnson, each with 4 layoffs. Since the beginning of 2024, the biopharma sector has shed more than 7,000 jobs. For context, a BioPharmaDive analysis counted more than 10,000 for 2023.

Merck’s M&A spending spree

While smaller biotech companies have struggled, several pharmaceutical giants have gone on acquisition sprees, scooping up promising often relatively mature companies. Merck & Co. has been especially active. In April 2023, the company acquired Prometheus Biosciences for $10.8 billion. The firm counted the acquisition as R&D, bringing its 2023 R&D spending to more than $30 billion.

Merck’s M&A activity momentum had been building for some time. In recent years, Merck acquired Acceleron ($11.5B), Imago BioSciences ($1.35B), and several others, culminating in the Prometheus deal. More recently, in January 2024, Merck acquired Harpoon Therapeutics for $680 million.

For historical context, some deals in years past were larger. In 2020, for instance, AbbVie acquired Allergan for $63.07 billion.

Pfizer reshapes operations with M&A and layoffs

In recent years, Pfizer has also been especially active — both in terms of layoffs and M&A deals. The company has recently undertaken a string of layoffs and operational reorganizations across its U.S. facilities as part of strategic adjustments within its global R&D and manufacturing operations to deal with reduced demand for COVID-19 therapies. These include layoffs at its Pearl River, New York vaccine R&D site, South San Francisco location and the halt of its Everett, Washington manufacturing plant construction. Before the sting of layoffs, the company had announced a series of high-profile acquisitions — most notably in 2021 to 2023. Notable purchases include Seagen ($43B), Global Blood Therapeutics ($5.4B) and Biohaven Pharmaceuticals ($11.6B). This string of acquisitions, including Reviral, Arena Pharmaceuticals, Trillium Therapeutics, and others, dates back to 2019 with the purchase of Array Biopharma ($11.4B).

Pfizer’s record-breaking revenue from its COVID-19 vaccine and Paxlovid antiviral fueled a surge in M&A activity. However, as demand for these products has declined, the company has announced a series of job cuts, including:

- 111 employees to be laid off by 6/19/2023 at its La Jolla research site

- 791 employees in New Jersey on 10/30/2023

- 500 roles cut at its Sandwich, Kent, U.K. site on 11/14/2023

- 285 employees at its Pearl River, NY R&D site on 1/4/2024

- 52 employees at its South San Francisco location on 1/29/2024

- 120 employees related to ending construction of a Seagen manufacturing plant on 3/6/2024

Other acquisitions and layoffs:

Big Pharma companies aren’t alone in shedding jobs. Some biotechs like TCR² Therapeutics, Inovio and Instil Bio have had to institute multiple rounds of layoffs. Additionally, Bluerock Therapeutics cut 12% of its workforce, MorphoSys laying off 17% at its headquarters, Spectrum Pharmaceuticals reducing R&D staff by 75%, Harpoon Therapeutics cutting 45% and Ambrx Biopharma shedding 15%.

NBI biotech stock index performance remains somewhat volatile

Looking at the NASDAQ Biotechnology Index (NBI) from 2014 to April 4, 2024 reveals a period of soaring growth during 2014 and 2015, peaking at 4165.87. But 2016 witnessed a sharp downturn, with the index dropping to 2524.44. The years 2017 and 2018 brought a period of recovery with modest gains, the index reaching a new high of 3842.66. During this time frame, there was a corresponding resurgence in biotech IPOs and increased merger and acquisition activity in the sector.

Signs of stabilization emerged in 2023, and 2024 appeared to be a year of early recovery, the index reaching a 4590.28, but also dropping recently, closing at 4,407.95 on April 4. Despite the recent decline, the NBI remains well above its 52-week low of 3,630.43. Recent data suggest that the NASDAQ Biotechnology Index (NBI) is likely to sustain recent performance trends in the coming months, pointing to the possibility of more volatility.

Filed Under: Biotech