Cambridge-based biotech Biogen has unveiled plans to cut 1,000 jobs, or 11% of its workforce, as it prepares for the launch of its newly approved Alzheimer’s disease drug, Leqembi (lecanemab) that it developed with Eisai. This move follows a pattern of significant layoffs, with the company having cut 885 jobs last year after the troubled rollout of its Alzheimer’s drug Aduhelm.

Cambridge-based biotech Biogen has unveiled plans to cut 1,000 jobs, or 11% of its workforce, as it prepares for the launch of its newly approved Alzheimer’s disease drug, Leqembi (lecanemab) that it developed with Eisai. This move follows a pattern of significant layoffs, with the company having cut 885 jobs last year after the troubled rollout of its Alzheimer’s drug Aduhelm.

The scope and rationale for the Biogen job cuts

Last year, Biogen eliminated 885 positions following the rocky launch of its initial Alzheimer’s drug Aduhelm in 2021. The latest job cuts are part of Biogen’s new “Fit for Growth” strategic plan aimed at prioritizing resources towards high-value programs with growth potential. The plan intends to deliver $1 billion in gross operating expense savings by 2025. After reinvesting $300 million into product launches and R&D, this would result in $700 million in net savings based on the company’s projections.

“As we looked at the R&D pipeline, we’ve had five different heads of R&D in 10 years. And that’s not good for an R&D organization,” said Biogen CEO Chris Viehbacher in the company’s Q2 earnings call. Consequently, the company “ended up with with some products” that were “relatively high risk and high cost and not necessarily the highest value,” Viehbacher said.

Biogen’s employee count following the recent layoff is in line with 2018 levels

Financial implications and ‘Fit for Growth’ plan

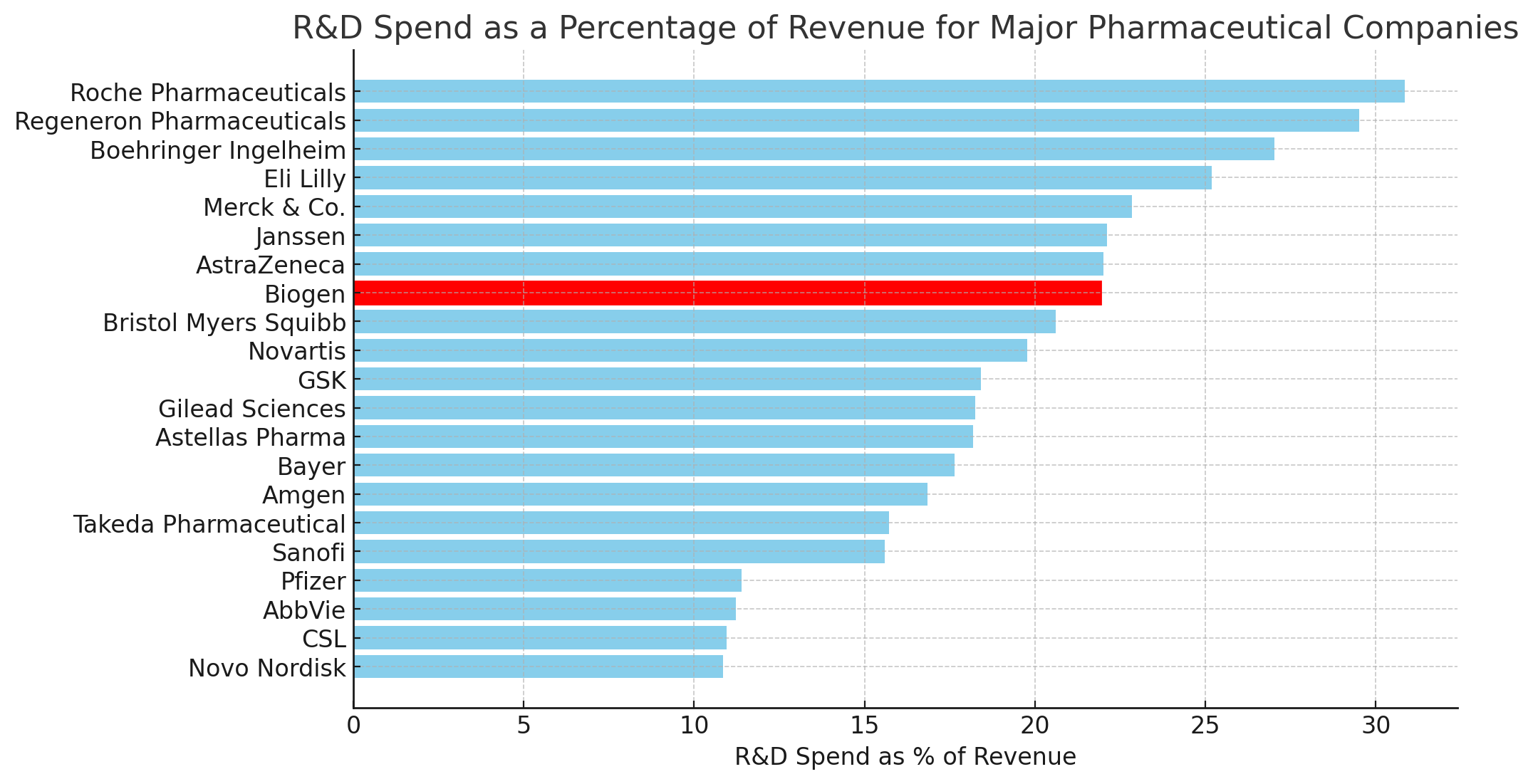

Biogen executives reasoned that the firm has “a relatively mature product profile,” Viehbacher said. “Generally, when you have a mature product profile, you’d expect a level of investment to go down. We have actually relatively high operating expenses when we benchmark versus other companies.”

To boost efficiency, Biogen also stated that it has substantially completed an R&D pipeline review and will now focus investments on the most promising neuroscience programs, including Leqembi. In 2022, Biogen directed approximately 22% of its total revenue towards R&D spending, above the industry average of around 14% according to Deloitte data.

R&D focus

Leqembi won accelerated FDA approval in January 2023 as a treatment for Alzheimer’s disease. In clinical studies, it demonstrated efficacy in a broad Alzheimer’s patient population. This accelerated approval required a confirmatory study verifying clinical benefit. On July 6, 2023, the FDA converted Leqembi to traditional approval following a determination that the confirmatory Clarity AD study verified a clinical benefit in slowing cognitive decline. Biogen is currently focused on physician education initiatives and establishing infusion centers to support the drug’s launch.

Biogen’s R&D spending was moderate as a percentage compared to some of its peers

Explaining the cost reduction, Viehbacher stressed the need to be “extremely disciplined” with capital. “From our benchmarking, Biogen has actually been better than average in terms of productivity, and there’s a lot of capability within the company,” he said. Viehbacher underscored that he continued to have a high degree of trust in the company’s R&D unit.

Christopher A. Viehbacher

According to Viehbacher, the secret to successful R&D is designing robust experiments that clearly define the criteria for moving to the next stage. He added that “you shouldn’t allocate capital unless those criteria are met.” Viehbacher observed that in many organizations, teams tend to “fall in love” with a project, and “even when the data isn’t clear, we keep moving forward.” He emphasized the need for discipline to “kill” projects that don’t meet their milestones, noting that “managing those R&D investments is probably more important than anything else.”

Launching Leqembi

The job cuts and strategic shifts arrive shortly after Biogen reported a 5% year-over-year decline in Q2 2022 revenue to $2.46 billion, alongside a 44% decrease in GAAP earnings per share. Following the July 25th announcement, Biogen’s stock price dropped around 2% in intraday trading and is down over 20% year-to-date.

Market response to the Biogen job cuts

While the layoffs will impact 1,000 Biogen employees, the company argues the moves will allow for greater investment in innovative programs. As Biogen balances short-term savings with long-term growth, the coming months will indicate whether its strategic gamble pays off.

Viehbacher stressed the need for the cost-reduction plan.

“We want to be making more value-based decisions for existing products,” Viehbacher said. “We don’t just want to remove the promotional effort. Biogen still has a 25% market share in multiple sclerosis, we have the highest market share by a considerable margin, and so there are a lot of patients who depend on Biogen products.”

Biogen stock performance

Filed Under: Neurological Disease