[Image courtesy of iStock Photo]

Georgia and Kazakhstan, for instance, could be new venues for life science companies looking to conduct clinical trials.

Russia and Ukraine both had strong clinical trial growth before 2022

Before the war’s disruption, Russia and Ukraine emerged as popular clinical trial sites. But the ongoing war in Ukraine has led to significant sanctions against Russia and logistical troubles.

“It has had a great impact on clinical trials,” said Andrey Tarakanov, CEO of the clinical trial logistics firm COREX Logistics . In addition to its Dublin, Ireland headquarters, COREX has locations in Kazakhstan, Georgia, Ukraine, Armenia, Russia and Belarus.

The number of clinical trials in Russia has skyrocketed in recent years from 71 in 2017 to 797 in 2021, according to GlobalData. In Ukraine, there were almost 400 clinical trials in April. That figure, however, has since fallen to 287, according to ClinicalTrials.gov.

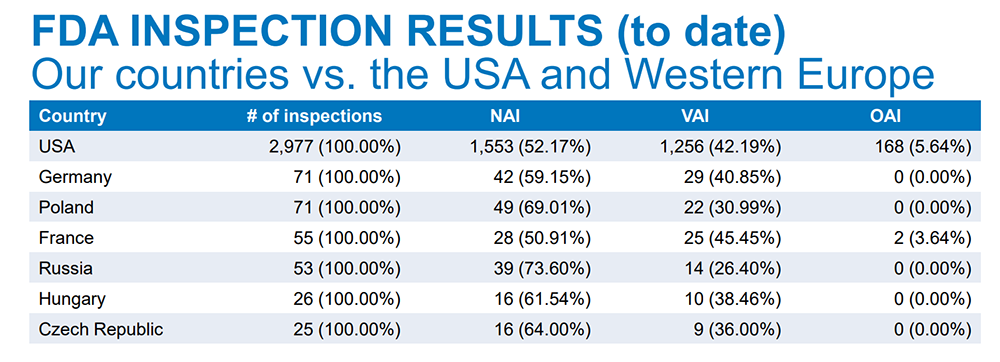

Russia, in particular, has a good regulatory track record for clinical trials. According to data gathered by COREX before Russia’s invasion of Ukraine, FDA inspectors determined there was no action indicated (NAI) for 73.60% of Russian clinical trials. For U.S.-based clinical trials, 52.17% reached the same benchmark.

[Image courtesy of COREX Logistics]

“Some companies postponed their clinical trial activities, but they did not quit them,” Tarakanov said.

By 2015 or 2016, clinical trial activities in the area stabilized.

Why Kazakhstan and Georgia have clinical trial promise

Before Russia invaded Ukraine on Feb. 24, 2022, roughly 3% of the world’s clinical trials were based in either country. A large portion of those focused on treating oncological, hematological and neurological diseases.

Dr. Andrey Tarakanov

But the Russia–Ukraine War is likely to persist for months or years, causing further clinical research disarray.

“I expect a decrease in clinical trials in Russia and Ukraine in the near future,” Tarakanov said.

Several countries near Russia or Ukraine — mostly with relatively little clinical trial expertise — could help fill the gap. Tarakanov floated a list of potential candidates, including Kazakhstan, Georgia, Tajikistan, Romania and Azerbaijan.

Georgia increased its presence in the clinical trials arena when Mikheil Saakashvili was the country’s president from 2008 to 2013. As a result, the government began to work toward establishing a robust clinical trial infrastructure. It has a strong medical system with highly trained physicians and experience with laboratory studies, including for pediatrics. Georgia also has swift clinical trial authorization timelines.

“Depending on the culture, it can take three, four or six months for approval,” Tarakanov said. “In Georgia, it usually takes only one month.”

Kazakhstan is also a burgeoning country for clinical trials. Industry giants ranging from AbbVie to IQVIA to Sanofi have a presence in the country.

The country’s research, academic and medical organizations have lent their support to clinical trials. Kazakhstan also invests in medical technology, increasing its health care budget by 16% between 2021 and 2022.

Many clinics in the country are private, offering autonomy in decision-making and giving sponsors freedom in selecting sites for clinical studies

Kazakhstan also has an advantage for Russian-speaking clinical trial experts. “Kazakhstan is very similar to Russia in terms of logical infrastructure,” Tarakanov said.

Kazakhstan also counts Russian as an official language next to Kazakh. “Doctors there write Medical documents in Russian,” Tarakanov said.

Russian clinical trial researchers looking to emigrate will also likely find it easier to relocate to Kazakhstan — or Georgia — than to Western Europe or the U.S.

Filed Under: clinical trials, Drug Discovery

Tell Us What You Think!

You must be logged in to post a comment.